$ALOR

Tokenomics

The Algorix token, ALOR, serves as a fundamental component within our ecosystem, driving utility and incentivizing stakeholder engagement.

Introduction

The ALOR project aims to create an innovative blockchain ecosystem comprised of three main platforms:

Prop Crypto: The world’s first crypto prop firm, offering skilled traders access to funded capital. Profits are split between traders and Algorix, creating a win-win model. Our challenges helps us to identify and empower the best trading talent in the market.

Decentralized Exchange (DEX): A secure and efficient platform for exchanging digital assets.

Dedicated Blockchain: Development of a custom blockchain with optimized capabilities and performance.

The ALOR token serves as the core of this ecosystem, and its tokenomics are meticulously designed to ensure sustainable growth, community participation, and continuous development.

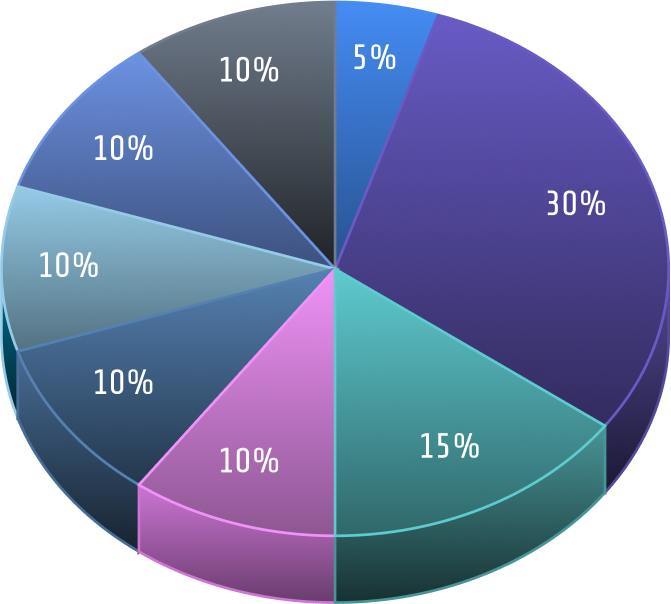

Token Allocation

A) PRE-SALES (5%)

Pre-sale Period: Pre-sale Period: October 12, 2024, to December 12, 2024

Timing and Pricing:Vesting: Tokens purchased during the pre-sale will be immediately available for trading after the pre-sale ends.

B) Ecosystem Development (30%)

Allocation:-Development of Prop Crypto: 7%

-Development of DEX: 7%

-Development of Dedicated Blockchain: 16%

Vesting:-Lock-up Period: Tokens are locked for 1 year.

-Release Schedule: After one year, tokens will be linearly released over 12 months.

Development Priority: ALOR holders will participate in prioritizing platform development through the governance system.

C) Marketing and Listing (15%)

Vesting:-Lock-up Period: 6 months from the listing date.

-Usage: After the lock-up period, tokens will be utilized for marketing activities and exchange listings.

D) CORE TEAM (10%)

Vesting:-Lock-up Period: 3 years from the listing date.

-Release Schedule: Tokens will be linearly released over 24 months post-lock-up and are contingent upon achieving project milestones.

E) STAKING REWARDS (10%)

Total Allocation: 300,000,000 ALOR over 3 years.

F) STRATEGIC PARTNERSHIPS (10%)

Vesting:-Lock-up Period: 6 months lock-up.

-Release Schedule: Tokens will be linearly released over 18 months after the lock-up period.

G) MARKETING (10%)

Vesting:-Community Governance: Token allocation for marketing activities will be determined over 3 years based on project needs and community participation.

H) MARKET MAKER (10%)

Usage:-Liquidity Provision: To ensure liquidity on exchanges and market stability.

-Release: Based on market needs and team decisions, with no specific lock-up period.

Token Utility

-Transactions: Used as a medium of exchange across all ALOR platforms.

-Staking: Users can stake ALOR to earn rewards.

-Governance: Token holders can participate in key project decisions.

-Access to Premium Services: Holding or spending ALOR unlocks advanced features and services within the platforms.

Inflationary and Deflationary Mechanisms

-Fixed Supply: The total token supply is fixed; no new tokens will be minted.

-Token Burn: A portion of transaction fees may be used to burn tokens, reducing circulating supply and potentially increasing token value.

Staking Rewards Program

Objective-Annual Staking Reward Rate: 12% per annum on staked tokens.

-Duration: 3 years.

-Total Tokens Allocated for Staking Rewards: 300,000,000 ALOR.

Staking rewards are calculated based on the number of tokens and a fixed rate of 12%, without considering token price appreciation.

Assumptions-Staking Participation Rate: 50% of circulating supply each year.

-Circulating Supply Each Year: Based on the vesting schedule and token release.

Estimated Circulating Supply Over 3 Years

Year 1

Circulating Supply at End of Year 1:-Pre-sale Tokens: 150,000,000 ALOR

-Market Maker (50% utilized): 150,000,000

ALOR-Marketing and Listing (after 6 months): 450,000,000 ALOR

-Strategic Partnerships (~33%): ~100,000,000 ALOR

-Marketing (distributed over 3 years): ~100,000,000 ALOR

Total Circulating Supply Year 1: 950,000,000 ALOR

Year 2

Tokens Unlocked:-Ecosystem Development: 900,000,000 ALOR

-Strategic Partnerships (remaining): ~200,000,000 ALOR

-Marketing: ~100,000,000 ALOR

Total Circulating Supply Year 2: 2,150,000,000 ALOR

Year 3

Tokens Unlocked:-Marketing: ~100,000,000 ALOR

Total Circulating Supply Year 3: 2,250,000,000 ALOR

Staking Rewards Calculation

Annual Staking Rewards

Rewards i = Token Staked i x 12%Token Staked

Token Staked i = Circulating Supply i x 50%Cumulative Rewards

Year 1

Tokens StakedTokens Staked = Tokens Staked = 950,000,000 x 50% = 475,000,000 ALORStaking RewardsRewards = 475,000,000 x 12% = 57,000,000 ALORCumulative RewardsCumulative Rewards = 57,000,000 ALORYear 2

Tokens StakedTokens Staked = 2,150,000,000 x 50% = 1,075,000,000 ALORStaking RewardsRewards = 1,075,000,000 x 12% = 129,000,000 ALORCumulative RewardsCumulative Rewards = 57,000,000 + 129,000,000 = 186,000,000 ALORYear 3

Tokens StakedTokens Staked = 2,250,000,000 x 50% = 1,125,000,000 ALORStaking RewardsRewards = 1,125,000,000 x 12% = 135,000,000 ALORAdjustmentSince the total allocation is 300,000,000 ALOR, we adjust the Year 3 rewards:Rewards = 300,000,000 - 186,000,000= 114,000,000 ALORCumulative RewardsCumulative Rewards = 186,000,000 + 114,000,000= 300,000,000 ALOR

Summary of Staking Rewards Over 3 Years

Governance

- Community Participation: ALOR holders can engage in voting on critical project decisions.- Voting System: One token equals one vote; decisions are made based on majority consensus.- Voting Topics:- Platform Development Priorities

- Marketing Budget Allocation

- Network Improvement Proposals

Security and Compliance

- Secure Smart Contracts: All contracts will undergo security audits by reputable firms.- Regulatory Compliance: The project commits to adhering to relevant cryptocurrency laws and regulations in applicable jurisdictions.- Transparency: Regular and transparent reporting to the community and investors.Marketing and Community Development

- User Acquisition Strategy: Through marketing campaigns, influencer partnerships, and educational programs.- Community Rewards: Airdrops and bounty programs to encourage active user participation.- Communication: Active presence on social media and effective communication channels with the community.RoadMap

Development and Launch (Q1 - Q2 2024)

- Market Research

- Strategic Planning

- Token Development

- Platform Prototype

Marketing and Platform Expansion (Q3 - Q4 2024)

- Private Sale and Pre-Sale

- Community Building

- Initial Fundraising

- Public Sale and IEO

Dedicated Blockchain Development (Q1 - Q2 2025)

- Platform Feature Expansion

- Strategic Partnerships

- Full Platform Launch

- Governance Features

Global Expansion and Innovation (Q3 - Q4 2025)

- Global Market Penetration

- Product and Service Innovation

- Research and Development

- Sustainability and Social Impact

Continuous Improvement and User Support (Q1 - Q2 2026)

- User Feedback Integration

- Technical Support Enhancements

- Regular Updates and Upgrades

- Advanced User Education Programs

Future Vision and Long-term Goals (Q3 - Q4 2026)

- Exploration of New Technologies

- Expansion into Emerging Markets

- Long-term Sustainability Initiatives

- Visionary Strategic Planning

Conclusion

The ALOR tokenomics are meticulously crafted to balance supply and demand, incentivize users, and provide necessary resources for sustainable project development. By calculating staking rewards based on token quantities and a fixed annual rate of 12% over 3 years, ALOR ensures both attractive returns for stakers and the sustainability of the rewards pool.

Final Remarks

Staking Rewards Cap: Staking rewards are capped at 300,000,000 ALOR over 3 years to maintain the integrity of the tokenomics.

Adjustment Mechanism: In case of changes in participation rates or market conditions, the team may propose adjustments through community governance.

Transparency: All calculations, assumptions, and any future adjustments will be transparently communicated to the community.

Note: This tokenomics plan may be updated as the project evolves and based on community feedback. We are committed to transparency and continuous engagement with our users and investors.